If you watched the Full Council meeting on November 20th 2024 you might have noticed a question put by Councillor Kevin Benton to the Cabinet. If you care about your hard earned money being spent well by the Council then you’ll want to take a look. Don’t worry if you’re not quite sure what the question is about (or indeed the answers provided by the 2 Cabinet Members who did respond). More on that below.

Wealden District Council (led by the Green Party, Labour, Lib Dem “Alliance”) is currently undertaking several large-scale capital projects. These range in size and scope and have been of interest to me since being elected in May 2023 (mainly due to the large amount of taxpayer funds that the Council is looking to use in attempting to deliver these projects). Whether it’s a sensible or prudent idea to deliver them is a whole other question entirely and something that I wanted to address with this post.

A bit of the history

It’s worth pointing out that it takes time to deliver projects of the scale that Wealden is currently pushing forward with. Many of them were conceived under the previous administration (i.e. before the Alliance for Wealden came into being). The projects are “managed” by a project Board (which is now the Cabinet made up of 7 politicians comprising Green Party, Liberal Democrat and Labour). The person whose “Portfolio” contains these items is Councillor Kelvin Williams (an ex-employee of Wealden District Council and Liberal Democrat). The economic environment has changed materially since many of these projects were started but there does not seem to be much (if any) appreciation for that fact in the way that the Alliance for Wealden is continuing to forge ahead with them. For example, interest rates are materially higher, construction costs have exploded meaning capital costs are much higher than originally envisaged and so on. Given the sums of money involved (which run into the millions) you’d think that they would be under constant review, with all options considered at every stage of the process. At the very least, you’d expect a full set of metrics to be available with project feasibility assessed against a statutory requirement to obtain “best value”.

make arrangements to secure continuous improvement in the way in which its functions are exercised, having regard to a combination of economy, efficiency and effectiveness.

Duty to obtain best value

The duty of obtain best value includes (in addition to financial and economic factors) the ability to consider environmental and social value, where “social value” is defined in the statutory guidance as the following: “social value is about seeking to maximise the additional benefit that can

be created by procuring or commissioning goods and services, above and beyond the benefit of merely the goods and services themselves.“

That sounds like a reasonable thing for a Council to have to do when considering the spending of valuable financial resources. There is, of course, a strong social value argument that can be made when building things like, (for example) a learner pool or medical centre. That value would obviously need to be measured (or quantified) in some way in instances where a proposal made absolutely no financial sense. This would ideally be done with a framework that could be repeated such that projects could be assessed on a like for like basis.

Wealden is not just undertaking projects for which the outcome is one for which they have a statutory responsibility for service delivery however. They are embarking on what are essentially commercial projects and this is where it gets interesting. In the time since the Alliance was formed they have chosen not to proceed (at this time) with a learner pool in Crowborough and have also scrapped a previous project called “Hailsham Aspires“. The learner pool was previously described as “High Priority” by Crowborough Town Council.

How does the Council assess financial viability?

Much of the detail around the strategic projects undertaken by the Council is provided in “Exempt” (ie confidential) reports. I’m therefore limited on what I can say so will speak in general terms only using “hypothetical figures” to illustrate the point.

I’ll start off by saying that I don’t think the WDC Cabinet has the skills or experience to assess projects of the scale being undertaken by WDC right now. There are people within the wider council Membership (myself included) that could add significant expertise and context to the discussion but the Green/Labour/Lib Dem Alliance isn’t particularly interested in working with the wider membership. Even when I was within the Alliance and Chair of the Audit, Finance and Governance Committee (which supposedly has “oversight” of the Council’s strategic projects), Wealden Officers (on the instruction of the Alliance) didn’t disclose rudimentary financial models that you would expect them to have even for projects a fraction of the scale that Wealden is undertaking. More recently, Councillor Daniel Manvell (a young Labour Councillor who is now somewhat worringly in charge of the Housing Revenue Account as a member of the Cabinet) rejected the idea of a working group to look at the viability of these projects at a recent Audit and Finance Committee meeting.

I would expect to see as a minium the following financial data on a capital project:

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- DCF valuation (where cashflows are anticipated)

- Capital Cost

- Discounted and undiscounted payback periods

- Return on Investment (ROI)

- Budget at Completion

- Estimate at Completion

- Sensitivity analysis of all of the above based on the assumptions made

The items on the list are fairly standard and, where calculations are required for things like the IRR, NPV, Payback periods the DCF are all simple things to generate if you have a competent team assessing, and managing the projects. Making decisions without much of the data outlined is a dereliction of responsibility in my view and we should put up with nothing less than robust justification for spending taxpayer money.

Alas, the only financial metrics we are typically provided for the capital projects are IRR and (in some cases) an undiscounted payback period. Not discounting the cashflows for the payback ignores the fundamental nature of money and the effect of inflation on future cashflows and their value today. This is a simple concept that even my children understand; not so with Wealden’s current Alliance led administration (or perhaps they do know but are afraid of how they’ll justify the facts to the residents of Wealden).

Councillor Benton’s question and the response

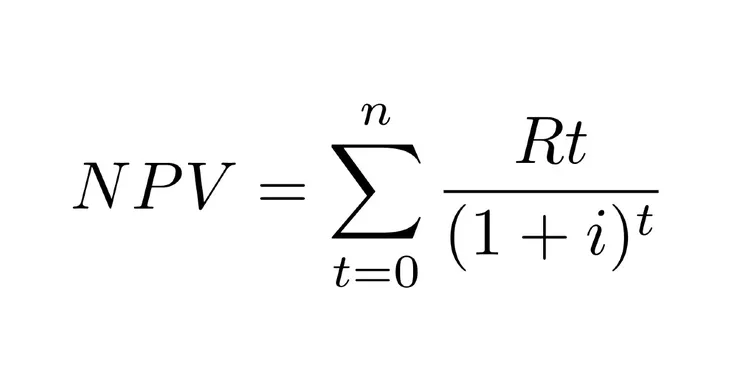

Councillor Benton asked to see an NPV calculation for each of the current capital projects. This is essentially a simple calculation that demonstrates the difference between cash inflows and outflows over a period of time. The formula for NPV is as follows where Rt = net cashflow for a single period, i = discount rate (the Treasury recommends 3.5% for public sector projects), t = time period (life of project). In simple terms, if the sum of the future cashflows is negative it would be illogical (in any logical financial scenario) to undertake the project. You wouldn’t invest £400 to get back £200 would you?

where Rt = net cashflow for a single period, i = discount rate (the Treasury recommends 3.5% for public sector projects), t = time period (life of project). In simple terms, if the sum of the future cashflows is negative it would be illogical (in any logical financial scenario) to undertake the project. You wouldn’t invest £400 to get back £200 would you?

Internal Rate of Return uses exactly the same inputs but you solve for i (the discount rate) such that the NPV is equal to zero. Thus, at any discount rate higher than the IRR the project would have a negative NPV. Essentially, the bigger the IRR the more robust the project is in economic terms. There are problems with just using IRR though. For example, IRR does not take into account a projects size (something that is obviously important when dealing with public money). IRR also ignores risk and uncertainty in a projects cashflows (or where your assumptions are overly optimistic for example). If you have a model capable of calculating IRR then it would literally take 2 minutes to produce an NPV value. The inputs are substantially similar.

Councillor Coleshill in response says that “the regular financial assessment is “Internal Rate of Review” (sic)” he goes on to say that IRR is used by Councils “up and down the country” with the implication being that it is common practice to use IRR in isolation. This is not accurate and I’ll get to that in a bit. Perhaps more worryingly Councillor Coleshill goes on to say “I think the important thing about calculations about financial viability is that they are set alongside calculations of social benefit“. That’s fair enough I suppose where you’re dealing with an asset delivered as part of the statutory responsibility of the Council (a learner pool for example). I’m less convinced where the project concerns a commercial investment (such as an industrial unit). A further concern is that the Finance Portfolio Holder (Councillor Greg Collins from the Green Party) agreed with this approach (watch the video above).

We don’t have the staff, the time, the resources… so we make a guesstimate

Councillor Paul Coleshill

Councillor Coleshilll goes on to say that Wealden does not have the staff, the time or the resources to undertake social value calculations so they guess a value. I’ve never even heard the Councillors suggest which framework they would use if they did undertake a calculation but suffice to say there are several methods they could use if they were so minded.

I personally find it worrying that decisions to spend large sums of money are being made based on the “guess” around social value. This problem is perhaps even more of a problem where the “Project Board” does not understand the concepts enough to even get the acronym right (Internal Rate of Return).

This is also at odds with the practice undertaken by other councils where 5 minutes on google would reveal Councillor Coleshill’s claims that IRR was the (sole) metric used to be inaccurate.

Is Wealden an outlier?

Looking at the practice of other Councils when it comes to project appraisal, Wealden does seem to be an outlier whose methods are inconsistent with the norm and also at odds with Guidance in the Treasury Green Book. For example, Bristol City Council has a capital strategy document which says the following: “All projects are required to have a positive NPV.” and on social value they say “The Environmental and Social impacts must be quantifiable to demonstrate best value“. Guessing wouldn’t cut the mustard in Bristol it would seem; and obviously given the lack of a provided NPV in Wealden means we have no officially produced figures to discuss. Oxford City Council also includes NPV, discounted payback period, cost/benefit analysis etc in their capital strategy document. There are many more examples that can be provided. I’ve not seen “guessing” mentioned anywhere.

What’s going on?

A cynical person might suggest that the Cabinet is well aware of the NPV and broader financial impacts of some of the more wasteful activities they are undertaking but they’re happy to squander the money knowing they can just raise taxes later. After all, if they don’t do the calculation they can legitimately claim they didn’t know. It’s a good thing I’m not “that” cynical.

I think it more likely that there is a lack of financial competence within the Cabinet (and broader Alliance). They view the hard won reserves built up over many years as a plaything and probably don’t understand the financial implications of the decisions they’re taking? How can they when they freely admit there isn’t the skills, staff or time to undertake the assessments?

We are not talking about small numbers here. In May 2023 the total figure (on the all the projects) was in excess of £100M. It’s a huge concern that 18 months down the line that the Council, under the Alliance continues to operate without the tools or data needed to make sound decisions. They are, as they say, guessing (betting) on outcomes with your money. A perfect storm of moral hazard.

I stood as a Councillor because I wanted to ensure that money wasn’t being wasted. Unfortunately, I think it is, and, absent evidence to the contrary, I think residents of Wealden should all be similarly concerned.

Please let me know your thoughts in the comments and if you’re a resident of Crowborough South East and would like to discuss this further please do get in touch.

Leave a Comment